Page 20 - PHG_Q&A_Eng.indd

P. 20

• They must be placed on a 12 month contract of employment.

BEE A further change introduced by the Code Amendments, relates to the

splitting of the skills development expenditure target for generic companies.

Currently the target is set at 6% of what is essentially payroll expenditure. The

Code Amendments propose reducing the target to 3.5% of skills development

programmes and introducing a new 2.5% of payroll target for expenditure on

bursaries to black learners. The total skills spend thus still remains 6%, but with

an emphasis on tertiary education bursaries introduced through the new 2.5%

target.

It will be interesting to see if the Code Amendments are passed as proposed,

although it is clear that they align strongly with current Government’s policy. If

they are passed, it will require generic companies to have a major rethink of

their current BEE strategy and planning.

Calculating your BEE Level under the new

Financial Sector BEE Charter

March 2018

“My insurance business falls under the new Financial Sector BEE charter which

recently came into effect. I’m struggling to understand how the new scoring

system works and how this will impact on the BEE level of my business. Could

you help clarify this?”

The Amended Financial Sector Codes of Good Practice (“Amended Codes”)

was gazetted on 1 December 2017 and came into effect immediately.

The Amended Codes differ from the generic Department of Trade and Industry

(DTI) Codes of Good Practice in their calculation of the BEE level requirements

as the Amended Codes include an additional formula which must be applied

to determine the final score of an entity that is measured under the Amended

Codes. This is where much of the confusion around the Amended Codes has

arisen from, as there are different calculations for the different entities that

operate within the financial services industry.

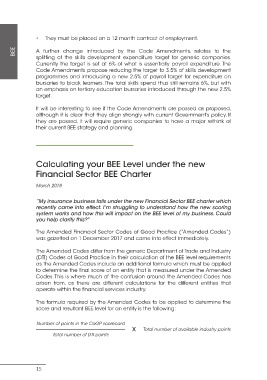

The formula required by the Amended Codes to be applied to determine the

score and resultant BEE level for an entity is the following:

Number of points in the CoGP scorecard

X Total number of available industry points

Total number of DTI points

15